Introduction

This paper discusses the relief provided by Texas in response to the COVID-19 crisis, including taxpayers’ responsibilities for Texas sales tax and Texas franchise tax reporting. The Comptroller has provided a blanket, automatic extension for Report Year 2020 Texas franchise tax reporting and payments to July 15, 2020. The Comptroller has not extended the sales tax reporting deadlines but has offered potential relief to taxpayers depending on their circumstances. Many local appraisal districts have extended rendition deadlines and the Comptroller has offered motor vehicle registration and titling extensions. The Comptroller has temporarily shuttered his field offices and has offered some relief to taxpayers in administrative redetermination proceedings. The Comptroller expects tax revenue to fall significantly but has not yet released an estimate of the impact of COVID-19 on tax collections.

Franchise Tax Relief

Texas Franchise Tax Automatic Extension for All Taxpayers. On April 2, 2020, the Comptroller announced that the due date for Report Year 2020 Texas franchise tax reports is automatically extended for all taxpayers to July 15, 2020.1 The automatic extension includes both the report deadline and the payment deadline. The Comptroller extended the franchise tax deadline “to be consistent with the Internal Revenue Service” which has extended certain federal income tax filing deadlines to July 15, 2020.2 The Comptroller’s press release explained the rationale for extending the franchise tax deadline:

“We recognize that the information aggregated from taxpayers’ federal tax returns comprises the building blocks for their Texas franchise tax returns,” Hegar said. “In addition to coping with the unprecedented impacts of the growing pandemic, we understand the difficulty Texas businesses will face in filing franchise tax returns now that the federal deadline has moved, and so we thought it appropriate to align the state’s franchise tax deadline with the IRS deadline.”3

In addition to the automatic extension, the Comptroller announced the process for requesting additional franchise tax extensions. These extensions, like those available every year, require taxpayers to file timely extension requests and include with those requests estimated tax payments. The extensions differ depending upon whether the taxpayer is required to pay franchise tax via electronic funds transfer (EFT).

Entities that paid $10,000 or more in franchise tax (or any other single category of payments or taxes) in the previous state fiscal year are required to pay using EFT.4

Additional Extensions for Non-EFT Taxpayers. Taxpayers who are not required to pay via ETF can request one additional extension using the Comptroller’s Webfile system or may file Form 05-164, Texas Franchise Tax Extension Request.5 If the taxpayer properly requests the extension, the report will be due January 15, 2021.

Non-EFT taxpayers must request the extension before the original due date for the report (July 15, 2020). Along with the extension request, the taxpayer must make an “extension payment” equal to the lesser of the following:

1. 90% of the tax that will be due with the report that is ultimately filed; or

2. 100% of the tax reported as due on the prior franchise tax report.6

A taxable entity that became subject to the franchise tax for the first time during the 2019 calendar year cannot use the 100% payment option to calculate its extension payment. Also, a separate entity that was included in a combined group report in Report Year 2019 cannot use the 100% payment option.7 Using the 90% payment option, however, requires the taxpayer to be able to calculate its expected Report Year 2020 franchise tax liability, which the taxpayer is typically unable to do before submitting its federal income tax return.

If the taxable entity fails to meet the “extension payment” requirements once it files its Report Year 2020 report, penalty and interest applies to any part of the 90% of tax not paid by the July 15, 2020 due date and to any part of the 10% not paid by the extended due date.8 If a taxpayer does not meet the minimum payment threshold, the extension is denied and the taxpayer’s report remains due on the July 15, 2020 due date.9

Additional Extensions for EFT Taxpayers (Two-Step). Taxpayers required to pay Report Year 2020 franchise tax via EFT must request two extensions. The first extends the due date to August 15, 2020, and the second extends the due date to January 15, 2021.

If the taxpayer paid between $10,000 and $499,999.99 in franchise tax in Report Year 2019, they may meet the extension payment requirement by using the Comptroller’s Webfile system to make their payment.

If the taxpayer paid $500,000 or more in franchise tax in Report Year 2019, they must use the Comptroller’s TEXNET system. They may request an extension by making a timely TEXNET payment using tax type payment code 13080 (Franchise Tax Extension). They must complete the payment information by 8:00 PM (CT) on Tuesday, July 14, 2020.10 Taxpayers do not use the Comptroller’s Form 05-164, Texas Franchise Tax Extension Request when using TEXNET and payment code 13080 (Franchise Tax Extension).11

Along with the extension request, the taxpayer must make an “extension payment” equal to the lesser of the following:

1. 90% of the tax that will be due with the report that is ultimately filed; or

2. 100% of the tax reported as due on the prior franchise tax report.12

Special restrictions apply to the use of these two options for combined groups and separate entities that were included in a combined group in the prior year.13

After receiving the first extension to August 15, 2020, the taxable entity may request a second extension to January 15, 2021. The taxpayer must use either Webfile or TEXNET (depending on the amount of tax paid in the prior year) to make a second extension payment. The second extension payment must be the balance of the amount that will ultimately be due minus the first extension payment. This requires the taxpayer to know with certainty its ultimate franchise tax liability. If the taxpayer has already paid 100% of the tax due for Report Year 2020 with its first extension request, it may use Form 05-164, Texas Franchise Tax Extension Request.14

Final Report Extensions. A final report and payment of tax are due within 60 days once a taxable entity no longer has Texas franchise tax nexus or is subject to Texas franchise tax.15 Taxpayers may request extensions for these reports using the Comptroller’s Webfile or TEXNET systems, or using the Form 05-164, Texas Franchise Tax Extension request. The appropriate method will depend on whether the taxpayer is required to pay the tax via EFT, and whether an EFT payor must use the Webfile or TEXNET systems. The taxpayer must make an estimated payment of at least 90% of the tax that is ultimately due. If the taxpayer files a timely extension request, the extended due date will be 45 days after the original due date, i.e., 105 days after it no longer has Texas nexus.16

Sales Tax Exemption for Disaster Restoration

Many companies are offering some form of coronavirus disinfection, decontamination, remediation, and cleanup service. Some of these services may be exempt under Texas’ disaster-related exemption.

Disaster Exemption. Texas offers a disaster-related exemption and nexus carveout that may be implicated by the COVID-19 crisis. Tex. Tax Code § 151.350 provides a sales tax exemption for labor to “restore” real or tangible personal property if “the restoration is performed on property damaged within a disaster area by the condition that caused the area to be declared a disaster area.” To claim the exemption, the amount of the charge for labor must be separately itemized.17 The exemption applies only to charges for otherwise-taxable labor and not the sale of tangible personal property.18

A “disaster area” is any area declared a disaster by either the Texas Governor or the U.S. President under specific state or federal statutory authority.19 On March 13, 2020, Texas Governor Greg Abbott issued Proclamation 41-3720, declaring a state of disaster in every Texas county due to the imminent threat posed by COVID-19.20 Under Texas law, a disaster declaration lasts 30 days unless renewed by the Governor.21 On April 12, 2020, Governor Abbott renewed the statewide disaster declaration.22

Texas provides exemptions from three categories of taxable services so long as the disaster declaration is in effect and the service is performed to restore property damaged by the condition that caused the disaster.

Real Property Repair, Restoration, and Remodeling Exemption. The disaster exemption applies to separately-stated charges for labor to repair, restore, or remodel real property.23 Labor charges to repair or remodel are typically taxable except for work on residential structures and adjacent improvements.24

Tangible Personal Property Repair and Restoration Exemption. The disaster exemption extends to separately-stated charges for labor to repair, restore, or remodel tangible personal property. The repair, remodeling, and restoration of tangible personal property is generally a taxable service.25

Personal Services Exemption. The disaster exemption applies to any charge to “launder, clean, repair, treat, or apply protective chemicals to an item” to the extent the service is an otherwise-taxable personal service.26 Laundry, cleaning, and garment services are typically subject to sales tax as “personal services.”27 This includes commercial carpet cleaning and repair, drapery cleaning, dry cleaning, garment repairs, laundry services, rug cleaning, treating or applying protective chemicals to carpet, upholstery, rugs, or drapery, and uniform or linen service cleaning.28

This exemption does not apply to “real property services.” Texas imposes sales tax on real property services such as trash removal, building or grounds cleaning, janitorial, or custodial services.29 The removal of hazardous waste is not taxed as a real property service.30

Claiming the Exemption. The Comptroller has not yet released guidance for service providers to claim the exemption for the COVID-19 disaster. Previous disasters have typically involved “hurricanes, tornadoes, fires and floods.”31 The Texas Attorney general has issued an Opinion finding that a property tax exemption for “damage” caused by a disaster must arise from physical damage rather than mere economic damage.32 The Attorney General based his Opinion, in part, on a dictionary definition of damage as “physical harm caused to something in such a way as to impair its value.”33 The potential presence of the COVID-19 virus on real or tangible personal property is arguably a form of physical harm that impairs the property’s value, since the virus itself is physically present (although not visible with the naked eye).

Service providers performing exempt services should obtain exemption certificates from their customers.34 The exemption certificates must include the service provider’s name and address, the customer’s name and address and a list of the items subject to the exemption (e.g., items being repaired). The certificate must also state the reason for claiming the exemption. For example, the Comptroller recommended using this explanation: “Repair due to Hurricane Harvey in Galveston County”35 after that storm hit the Texas coast.

Sales Tax Relief

No Automatic Sales Tax Extension. The Comptroller has not extended the sales tax reporting and payment deadlines that are already in place and appears unlikely to do so. In his press release for the franchise tax extension, Comptroller Hegar noted “[u]nlike the sales and use tax, the franchise tax is not collected from the consumers of those taxable entities.”36 This seems to hint at the Comptroller’s rationale for extending the franchise tax deadline but not the sales tax deadlines. Adding to this, the Comptroller’s webpage for COVID-19 news notes that sales taxes are “collected from customers” and the Comptroller expects that “virtually all of our taxpayers are doing their best to remain in compliance and be responsible in submitting the taxes they collected from customers.”37

A seller in Texas collects sales tax from its customers and “holds the amount so collected in trust for the benefit of the state.”38 Under this “trust fund theory” of sales tax, the seller is prohibited from using Texas sales tax collections to pay owners, employees, or other bills, and may face steep tax penalties and potential criminal charges if he or she does so. Because sellers are expected to hold the funds “in trust,” the Comptroller is unlikely to provide an automatic extension of sales tax deadlines, for fear the funds may be spent on more immediate expenses. Most sellers report sales tax on an accrual basis which means that many sellers report sales tax to the state before they have received payments from their customers.

Short-Term Payment Agreements and Potential Penalty &Interest Waivers. While the Comptroller has not extended the deadlines for all taxpayers, he appears receptive to providing some relief for taxpayers affected by the COVID-19 crisis. The Comptroller’s webpage notes that for business “that are struggling to pay the full amount of sales taxes they collected from their customers prior to April 1, 2020,” the agency “is offering assistance in the form of short-term payment agreements and, in most instances, waivers of penalties and interest.”39 The Comptroller is likely to extend similar payment agreements and penalty & interest waivers for March sales tax collections due by monthly filers to be remitted in April.

However, on April 16, 2020, the Comptroller updated his COVID-19 emergency webpage to state:

We understand the closures and/or reduced ability to operate was unexpected and sudden, impacting taxpayers’ business finances and operations. But it is important to remind all taxpayers that state and local sales taxes collected from their customers are trust fund revenues and, by law, are not intended to be used by businesses as operating funds. Please keep in mind that the sales taxes that taxpayers are continuing to collect from consumers in their current ongoing limited operations after April 1, 2020, will be due on the applicable future due dates with an expectation of full payment of the collected taxes.40

This appears to indicate Comptroller Hegar will be more reluctant to offer short term payment agreements on favorable terms for sales taxes collected after April 1, 2020 and thereafter.

Taxpayers can access the Comptroller’s forms to request waiver of penalties and interest at https://comptroller.texas.gov/taxes/waivers/. Taxpayers who are required to remit funds by electronic funds transfer (EFT) should complete Comptroller Form 89-225 Request for Waiver of Penalty for Failure to File and/or Pay Electronically.41 Non-EFT taxpayers should complete Comptroller Form 89-224 Request for Waiver of Penalty for Late Report and/or Payment.42 After completing the appropriate penalty waiver request form, taxpayers can submit the form via email to eft.waivers@cpa.texas.gov (for EFT filers) or waivers@cpa.texas.gov (for non-EFT filers). To learn about short-term payment agreements and penalty & interest waivers, taxpayers can call the Comptroller’s Enforcement Hotline at (800) 252-8880.

Property Tax Relief

Disaster-Related Exemption. During the 2019 regular session, the Texas Legislature enacted a temporary property tax exemption for property damaged within an officially declared disaster area.43 The statute provides for a percentage-based property tax exemption based on the degree of damage to the property. The Legislature added the exemption to the Tax Code in response to the damage caused by Hurricane Harvey.

The statute does not indicate whether the damage must be physical damage, or whether economic damage caused by the disaster makes property eligible for the exemption. On April 13, 2020, Attorney General Ken Paxton issued Opinion No. KP-0299, finding that “a court would likely conclude that the Legislature intended to limit the temporary tax exemption to apply to property physically harmed as a result of a declared disaster. Thus, purely economic, non-physical damage to property caused by the COVID-19 disaster is not eligible for the temporary tax exemption . . . .”44 Although the Attorney General’s Opinion is not legally binding, local appraisal districts are likely to defer to the Attorney General and deny any applications for exemption based on purely economic damage.

Rendition Date Automatic Extensions. Local property tax appraisal districts have extended the deadline for business owners to file personal property renditions for 30 days. These extensions have been issued by many local appraisal districts including Houston’s Harris County Appraisal District,45 Austin’s Travis Central Appraisal District,46 the Dallas Central Appraisal District,47 and San Antonio’s Bexar Appraisal District.48 The deadline in these counties to file renditions is now May 15, 2020. Business owners in other counties should contact their local appraisal district to determine if similar extensions have been granted.

Comptroller Oversight. The Comptroller has discontinued in-person appraisal review board training until further notice.49 The Comptroller’s Property Tax Assistance Division is encouraging arbitrators to conduct property tax arbitration hearings by telephone.50 The Comptroller is also limiting the scope of its property tax oversight via MAP reviews and has extended the deadline for responses to the Appraisal District Operations Survey for 2019 to April 30, 2020.51

Motor Vehicle Tax Relief

Temporary Extension of Registration and Titling. Governor Abbott and the Texas Department of Motor Vehicles have granted a temporary extension for the registration and titling of purchased vehicles. This gives car dealers and individual buyers more time before they must appear in person at a county tax assessor-collector office. The extension is designed to “further the current societal goal of social distancing.” The Comptroller’s office is providing an extension of “up to 90 days past the original due date to pay the motor vehicle tax due on these purchases.” Late penalties will begin to accrue after the 90-day extension expires. The extension does not apply to seller-financed motor vehicle sales, because the tax is reported and paid directly to the Comptroller’s office instead of local tax assessor-collector offices.52

Existing Payment Plans Relief

Postponement of Deadlines Under Existing Payment Plans. To help cash-strapped taxpayers avoid defaulting on existing payment plan agreements, the Comptroller’s office is considering requests to extend payment deadlines on a case-by-case basis. The Comptroller will only consider extending deadlines for payment plan agreements for tax periods prior to the February 2020 tax report. Any postponements will not extend taxpayers’ due dates for remitting or reporting tax collected on behalf of state and local governments. The Comptroller will not extend deadlines for resolution agreements that call for a single lump sum payment to cover the entire liability. The postponement will not result in a reduction of the tax ultimately due, since postponed payments will be added to the end of the term of the agreement.53

Redetermination Relief

60-Day Deadline to Contest Audit Results Suspended. Typically, after a taxpayer receives its final audit results or a letter denying a claim for refund, the taxpayer has 60 days to request an administrative redetermination through a SOAH hearing.54

The Comptroller has suspended temporarily the 60-day deadline for businesses to contest audit results for both redetermination and refund hearings.55 For tax delinquencies, the Comptroller will waive interest accrued while the deadline is suspended temporarily. The Comptroller will later notify businesses of the ultimate deadline.

If a taxpayer is willing and able to request a hearing prior to its original 60-day deadline, the Comptroller has stated his staff can handle the requests. Taxpayers should visit the Comptroller’s website to learn how to request a refund hearing56, and can still email Audit Processing to request a redetermination hearing.57

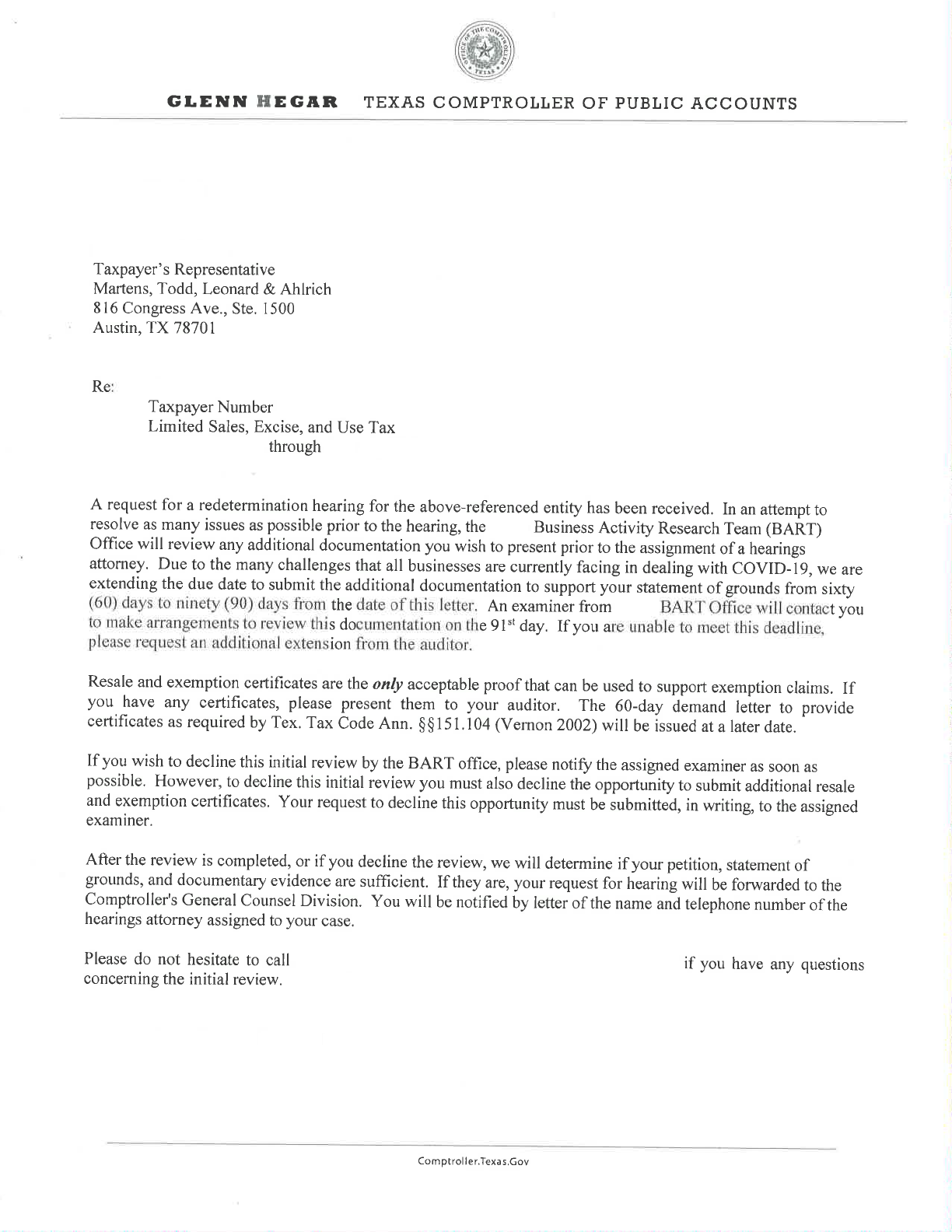

Audit Documentation Deadlines Extended. After submitting a redetermination request, a taxpayer typically receives a notification from the Comptroller stating that the taxpayer has 60 days to submit any additional audit documentation. This letter also starts a 60-day period during which the taxpayer must submit any outstanding exemption or resale certificates, or the Comptroller will not accept the certificates and will treat the sales as taxable.58

Recently, the Comptroller has issued this letter with two critical modifications:

1. The Comptroller has extended the deadline to submit general documentation in support of a statement of grounds from 60 days to 90 days. The Comptroller asks that taxpayers request additional extensions if they are unable to comply with the 90-day deadline.

2. The Comptroller’s initial letter provides that “the 60-day demand letter to provide [resale and exemption certificates] will be issued at a later date.”

The Comptroller has not provided definitive timeframes for the resale and exemption certificate deadlines. His response will likely depend upon the duration of the COVID-19 crisis.

An example of the Comptroller’s letter to taxpayers who have recently filed redetermination requests is provided below:

Example Redetermination Letter (see end of Blog post)

Audit and Taxpayer Service

Audit and Taxpayer Services Offices Closed

Taxpayer Services and Collections Offices Closed. The Comptroller’s Taxpayer Services and Collections field offices are temporarily closed. The Comptroller has the following online resources for taxpayers to use in lieu of calling or visiting local field offices:

· Webfile59 (including tutorials)60

· Change of Address of Phone Number61

· Close a Business Location62

· View Franchise Tax Account Status63

· Request Tax Certificates and Tax Clearance Letters64

Audit Offices Closed. The Comptroller’s audit field offices are temporarily closed. The Comptroller’s employees are primarily working remotely in response to the COVID-19 crisis. The Comptroller’s auditors have been able to work remotely for several years already, so the Comptroller does not anticipate his audit function to be hampered by not operating audit field offices. The Comptroller is using phone conferencing and WebEx videoconferencing to facilitate his office’s work remotely.65 With audit offices closed, auditors may be under less pressure temporarily to impose harsh assessments against taxpayers, so now may be a good time to try to negotiate resolutions of issues in ongoing audits.

State & Local Tax Revenue

The Texas Comptroller expects widespread tax revenue shortfalls as a result of business closures arising from the COVID-19 crisis. The revenue shortfalls are compounded by recent declines in oil prices. In a recent interview with Texas Tribune, Comptroller Hegar explained that it is still too soon to forecast the decline in tax revenue.66

There are several ways the State could respond to the decrease in revenue. The Texas Legislature may increase tax rates when it convenes the regular session in 2021, or Governor Abbott may call the Legislature into a special session before then. The State may offer a tax amnesty program as a tool to bolster tax collections in the short term while helping delinquent taxpayers come into compliance. Texas has the nation’s largest economic stabilization fund, commonly known as the “rainy day fund” to use as a cushion against revenue shortfalls.67

About Martens, Todd, Leonard & Ahlrich

Martens, Todd, Leonard & Ahlrich is a trial and appellate law firm headquartered in Austin, Texas. It handles only Texas tax cases, specifically those involving the Texas sales tax and Texas franchise tax. The firm’s attorneys have handled cases all the way through the Texas Supreme Court and U.S. Supreme Court. They speak and write frequently on a variety of Texas sales tax and franchise tax topics and have published articles in publications such as the Journal of State Taxation, the Texas Bar Journal, the Texas Lawyer, and the Texas Tech Administrative Law Journal. For more information, please visit texastaxlaw.com.

1. Texas Comptroller, Comptroller’s Office Extends Franchise Tax Deadline (Apr. 2, 2020), available at https://comptroller.texas.gov/about/media-center/news/2020/200402-extend-tax-deadline.php.

2. Internal Revenue Service, IR-2020-58 Tax Day now July 15: Treasury, IRS extend filing deadline and federal tax payments regardless of amount owed (Mar. 21, 2020), available at https://www.irs.gov/newsroom/tax-day-now-july-15-treasury-irs-extend-filing-deadline-and-federal-tax-payments-regardless-of-amount-owed.

3. Texas Comptroller, Comptroller’s Office Extends Franchise Tax Deadline (Apr. 2, 2020), available at https://comptroller.texas.gov/about/media-center/news/2020/200402-extend-tax-deadline.php.

4. Comptroller Rule 3.9(b).

5. Texas Comptroller, Franchise Tax Extensions of Time to File, https://comptroller.texas.gov/taxes/franchise/filing-extensions.php (last visited Apr. 20, 2020). Access to the Comptroller’s Webfile system and downloadable forms are available at https://comptroller.texas.gov/taxes/file-pay/.

6. Id.

7. Id.

8. Id.

9. Failing to secure a valid extension causes the statute of limitations to begin running on the original due date. Tex. Tax Code § 111.201 (four-year limitations period begins once tax is due and payable).

10. Texas Comptroller, Franchise Tax Extensions of Time to File, https://comptroller.texas.gov/taxes/franchise/filing-extensions.php (last visited Apr. 20, 2020). Access to the Comptroller’s Webfile and TEXNET systems and downloadable forms are available at https://comptroller.texas.gov/taxes/file-pay/.

11. Id.

12. Comptroller Rule 3.585(f).

13. Comptroller Rule 3.585(f)(3)(B).

14. Texas Comptroller, Franchise Tax Extensions of Time to File, https://comptroller.texas.gov/taxes/franchise/filing-extensions.php (last visited Apr. 20, 2020). Access to the Comptroller’s Webfile and TEXNET systems and downloadable forms are available at https://comptroller.texas.gov/taxes/file-pay/.

15. Comptroller Rule 3.584(c)(4).

16. Texas Comptroller, Franchise Tax Extensions of Time to File, https://comptroller.texas.gov/taxes/franchise/filing-extensions.php (last visited Apr. 20, 2020). Access to the Comptroller’s Webfile and TEXNET systems and downloadable forms are available at https://comptroller.texas.gov/taxes/file-pay/.

17. Tex. Tax Code § 151.350(a)(1).

18. Tex. Tax Code § 151.350(b).

19. Tex. Gov’t Code § 418.014.

20. 45 Tex. Reg. 2094 (Mar. 27, 2020).

21. Tex. Gov’t Code § 418.014(c).

22. Governor Greg Abbott, Proclamation by the Governor of the State of Texas available at https://gov.texas.gov/uploads/files/press/DISASTER_renewing_covid19_disaster_proc_04-12-2020.pdf (last visited Apr. 20, 2020).

23. Tex. Tax Code § 1510350(d)(2)(A).

24. Tex. Tax Code § 151.0047.

25. Tex. Tax Code § 151.0101(a)(5). Repair, remodeling, and restoration of aircraft, watercraft, and motor vehicles are not subject to sales tax. Tex. Tax Code § 151.0101(a)(5)(A)–(C).

26. Tex. Tax Code § 151.350(d)(1).

27. Comptroller Rule 3.310.

28. Comptroller Rule 3.310(b).

29. Tex. Tax Code § 151.0048(a)(3)–(4).

30. Tex. Tax Code § 151.0048(a)(3)(A).

31. Texas Comptroller Publication 94-182 Disasters and Texas Taxes (Sept. 2019).

32. Texas Attorney General Opinion KP-0299 available at https://www.texasattorneygeneral.gov/sites/default/files/opinion-files/opinion/2020/kp-0299.pdf (last visited Apr. 14, 2020) (see Property Tax Relief Section below).

33. Texas Attorney General Opinion KP-0299 available at https://www.texasattorneygeneral.gov/sites/default/files/opinion-files/opinion/2020/kp-0299.pdf (last visited Apr. 14, 2020) (quoting Webster’s Third New Int’l Dictionary 436 (2002).

34. Texas Comptroller Publication 94-182 Disasters and Texas Taxes (Sept. 2019).

35. Texas Comptroller Publication 94-182 Disasters and Texas Taxes (Sept. 2019).

36. Texas Comptroller, Comptroller’s Office Extends Franchise Tax Deadline (Apr. 2, 2020), available at https://comptroller.texas.gov/about/media-center/news/2020/200402-extend-tax-deadline.php.

37. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020).

38. Tex. Tax Code § 111.016(a) (providing for personal liability for tax collected no remitted).

39. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020).

40. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020).

41. https://comptroller.texas.gov/forms/89-225.pdf.

42. https://comptroller.texas.gov/forms/89-224.pdf.

43. Tex. Tax Code § 11.35

44. Texas Attorney General Opinion KP-0299 available at https://www.texasattorneygeneral.gov/sites/default/files/opinion-files/opinion/2020/kp-0299.pdf (last visited Apr. 14, 2020).

45. Harris County Appraisal District, News Release (Mar. 24, 2020), available at https://hcad.org/assets/uploads/pdf/20-07-HCAD-Grants-Businesses-30-Day-Rendition-Extension.pdf (last visited Apr. 20, 2020).

46. Austin Central Appraisal District, Travis Central Appraisal District Extends Property Owner Rendition Deadline to May 15, https://www.traviscad.org/news/travis-central-appraisal-district-extends-property-owner-rendition-deadline-to-may-15/ (last visited Apr. 20, 2020).

47. Dallas Central Appraisal District, Online BPP Renditions, http://bpprenditions.dallascad.org/ (last visited Apr. 20, 2020)

48. Bexar Appraisal District, Press Release (March 24, 2020), http://www.bcad.org/data/_uploaded/file/PDFs/Press%20Release%20-%20Automatic%20Rendition%20Extension.pdf (last visited Apr. 20, 2020).

49. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020).

50. Comptroller Rule 9.4261(b) (authorizing telephonic hearings).

51. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020).

52. Texas Comptroller, Motor Vehicle – Sales and Use Tax, https://comptroller.texas.gov/taxes/motor-vehicle/sales-use.php (last visited Apr. 20, 2020).

53. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020)

54. Tex. Tax Code §§ 111.009(a), 111.105(a).

55. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020).

56. https://comptroller.texas.gov/taxes/audit/refund.php. Taxpayers should consult with a state and local tax attorney or other competent tax advisor before requesting a refund hearing.

57. Audit Processing can be reached at audit.processing@cpa.texas.gov. Taxpayers should consult with a state and local tax attorney or other competent tax advisor before requesting a redetermination hearing.

58. Tex. Tax Code §§ 151.054, 151.104.

59. https://mycpa.cpa.state.tx.us/securitymp1portal/displayLoginUser.do

60. https://comptroller.texas.gov/taxes/file-pay/about-webfile.php

61. https://comptroller.texas.gov/web-forms/manage-account/change-address/

62. https://comptroller.texas.gov/web-forms/manage-account/close-location/

63. https://comptroller.texas.gov/taxes/franchise/coas-instructions.php

64. https://comptroller.texas.gov/taxes/franchise/certificate-letter-request.php

65. Texas Comptroller, COVID-19 News, https://comptroller.texas.gov/about/emergency/ (last visited Apr. 20, 2020).

66. Kate Winkle, Q&A: Texas Comptroller Glenn Hegar Discusses the Coronavirus Impact on State Economy with Texas Tribune, KXAN, Apr. 7, 2020, https://www.kxan.com/news/coronavirus/qa-texas-comptroller-glenn-hegar-discusses-the-coronavirus-impact-on-state-economy-with-texas-tribune/ (last visited Apr. 20, 2020).

67. The economic stabilization fund had a fiscal year-end balance of over $10 billion in 2019. Texas Comptroller, ESF History Table through Nov. 30, 2019, https://fmx.cpa.texas.gov/fmx/legis/esf/index.php (last visited Apr. 20, 2020).

About Martens, Todd, Leonard & Ahlrich

Martens, Todd, Leonard & Ahlrich is a trial and appellate law firm headquartered in Austin, Texas. It handles only Texas tax cases, specifically those involving the Texas sales tax and Texas franchise tax. The firm’s attorneys have handled cases all the way through the Texas Supreme Court and U.S. Supreme Court. They speak and write frequently on a variety of Texas sales tax and franchise tax topics and have published articles in publications such as the Journal of State Taxation, the Texas Bar Journal, the Texas Lawyer, and the Texas Tech Administrative Law Journal. For more information, please visit texastaxlaw.com.